“The ATO does not provide advice to tax debtors on insolvency processes, however one option available to small businesses may be small business restructuring (SBR). The SBR process is designed to allow financially distressed, but commercially viable businesses, the opportunity to restructure their debts whilst continuing to trade.

Vivek Chaudhary, Deputy Commissioner, Lodge and Pay

If you know your clients are struggling to pay their debts, talk to them about the streamlined restructuring or insolvency measures the government has established to support better outcomes for small businesses, creditors, employees and the economy.”

Speech at the Tax Institute 2023 Tax Summit

7 September 2023

Reach Vivek’s full speech below.

Good morning and thank you all for having me here today.

I would like to begin by acknowledging the traditional custodians of the land on

which we meet today and pay my respect to their elders past and present. I extend

that respect to Aboriginal and Torres Strait Islander people here today.

Yesterday the Commissioner reflected on more than a decade of change and

innovation at the ATO and outlined his challenge to the tax profession in Australia to

be ‘future fit’.

The Commissioner spoke about collaboration with the profession and the

importance of sparking change together for the benefit of all Australians.

Today I’ll be talking about our return to normal operations, and how you can support

your clients in understanding our position and meeting their obligations.

What I’m really talking about is paying tax on time. Australians have historically been

very good at paying tax on time, whether by design – because tax is withheld from

wages – or through our positive payment culture, where paying tax is seen as the

right thing to do.

1 of 12

Australia has a strong tax compliance culture. Our levels of voluntary compliance

are world leading.

Last year, more than 80% of income tax returns and 70% of activity statements

were lodged on time – that’s about 16.3 million tax returns and 9.7 million activity

statements lodged by the due date.

The statistics are similar for payment. Each year, almost 90% of tax liabilities are

paid on time.

Through the pandemic we shifted our focus from debt collection to stimulus

payments and assistance with tax, but it is now time to re-establish the culture of

paying tax on time.

We know that many people are facing cost of living pressures right now.

The majority of taxpayers do the right thing in paying tax in full and on time. We also

know the community expects all taxpayers to pay the right amount of tax.

Where we see businesses behind with tax, there is a fair chance they are also

falling behind in payments to creditors, suppliers and even employees. This is not

good for those directly impacted, the tax system, or the business itself.

Today I will outline what we are seeing in the market, what we are doing to reset

our positive payment culture, and how you can help us given your unique role as a

trusted adviser – shaping the culture and behaviour of Australian businesses paying

their tax on time.

Payment culture in Australia right now

During the early days of the pandemic, the ATO deliberately shifted down a gear in

respect to debt collection.

We redeployed over 5,000 staff, including staff from debt collection, to stimulus

payments and turned our attention to focus on how we could help and assist

taxpayers. As part of this we paused most of our firmer debt collection actions,

which was appropriate at the time.

We had to act fast, and in many instances, we didn’t ask for evidence, we simply

provided support.

We accepted this support would be for a defined period, and we offered a range of

concessions, with limited exclusions.

We encouraged taxpayers to ‘lodge even if you can’t pay’, we offered payment

plans, deferred due dates and remitted penalties and interest without question.

Offering additional time to pay was an effective lever to help small businesses stay

on track and a large portion of bills were paid before deferred due dates.

For a lot of businesses this was the right thing to do, and it delivered many

2 of 12

successes, but it has also had an impact on payment culture, and we are seeing

more businesses not paying tax on time since before the pandemic begun.

We can see that too many businesses have accumulated unsustainable levels of

debt. We want to guard against our payment culture turning from consistently

paying on time to paying late.

Collectable debt has increased over the past 4 years from $26.5 billion in June

2019, to $50.2 billion by June 2023 – this is an 89% increase and a trend we need

to turn around.

This is the collectable debt for businesses, which account for 90% of the total

collectable debt. A vast majority of this debt is self-reported by businesses

themselves.

Small businesses continue to be over-represented in our debt book, owing over

$33 billion of the $45 billion of collectable debt owed by all businesses.

I also want to make this point clear: although small business is overrepresented

here, non or late payment is our focus across the board, from individual taxpayers

all the way up to the big end of town.

But these are concerning, and unsustainable trends and we are currently working

on addressing this behaviour in the biggest group we see, which is small

businesses.

$23 billion of small business collectable debt is unpaid activity statement debt.

It includes pay as you go withholding and GST that a business has collected and

received credits for but hasn’t remitted.

$1.8 billion of the $33 billion is unpaid superannuation guarantee charge that has a

direct impact on employees.

For many of your clients the most important interaction with the ATO relates to

receiving a refund or making a payment.

Payment is a critical part of the equation because without payment your clients

aren’t complying with their obligations. We need your help to engage your clients on

this important issue.

We also see a number of profitable businesses who have the capacity to pay their

bills but are choosing not to.

Businesses appear to be de-prioritising payment of tax and super when they should

be provisioning for these bills like they would with any other business expenses.

We are hearing more and more from tax professionals that some businesses are

waiting for us to contact them, rather than taking early actions to pay.

As a consequence of our more lenient approach during the pandemic, we have

3 of 12

seen an increased expectation that interest and penalties will be remitted.

For a vast majority of taxpayers that pay their taxes on time, it’s unfair for them that

some are choosing not to.

Our expectation is, and should continue to be, that all clients will pay on time and

not wait for us to chase them or expect concessions from the ATO.

The ATO has an important role to create a level playing field for those businesses

who always pay on time. We are unapologetic about this role, and it must be done.

The community expects us to get on top of this, and I’m sure the tax profession

supports this view.

This is why we are returning to normal debt collection now.

We need to bring collectable debt down for the benefit of the Australian community.

Success will require a shift away from the COVID payment culture into a normal

payment culture, and we need your help to do it.

Of course, the majority of taxpayers will feel no change, and will be well placed to

continue to keep up to date with their lodgment and payment obligations.

For those clients who aren’t keeping up, engaging with us means we don’t mistake

no engagement as evidence of behaviours we are concerned about.

The best way for us to provide the right support for clients who otherwise have a

good payment history, but who now find themselves in financial difficulties, is to

contact us early – before the due date.

How we are addressing the debt

This year we carefully and thoughtfully returned to business-as-usual when

collecting overdue debts.

We have started working to reset expectations, and many businesses are already

feeling the impacts.

You will have seen more activity over the last 12 months, with an increase in firmer

actions, and a willingness to escalate to legal actions, for large debts especially

those who are choosing not to engage.

We are reaffirming our expectations of clients and resetting what clients can expect

of the ATO.

Practically speaking, this means you and your clients can expect to see us acting

earlier than we have been.

We know that preventing debt is the best way for businesses to stay on track, and

we have seen that leaving debts unchecked and unmanaged for prolonged periods

of time rarely improves future viability of a business. We have a role to also protect

4 of 12

the taxpayers from accumulating debt that becomes a burden for the rest of their

life.

Those who pay late or do not pay and do not proactively engage with us will have

interest and penalties apply to their debts. We do not want clients to rely on

remissions and will consider them only in very limited circumstances.

Clients who make a choice to contact us early, will be best placed to discuss

options that are available.

And early means before missing the due date. Those who wait for us to chase

payment after the due date can expect a different experience, with very limited room

for concessions.

For many businesses, the most effective payment plans will put them back to

square before their next reporting cycle – ensuring they are back on track before

new debts accumulate.

This means for the majority, shorter repayment periods of 90 days to 12 months.

Taxpayers contacting us can expect a conversation about making payment in full

and if this is not possible, we will assess their capacity to pay so we can determine

an appropriate and manageable payment plan that is finalised in the shortest

possible time.

We recognise that this will present challenges for some businesses who continue to

face pressures resulting from higher costs of living and interest rates.

Interest remission requests will be assessed on case-by-case basis, considering

exceptional circumstances and specific factors contributing to inability to pay.

There are 5 specific areas of focus, where our reset will be most noticeable.

Unpaid super guarantee charge

The majority of unpaid superannuation guarantee charge – $1.8 billion – is owed by

small businesses.

Super belongs to employees. It’s for their future retirement. It’s not designed to be a

cashflow buffer. The government recently announced payday super which is

designed to strengthen the Super system, and support employer’s payroll

management with fewer liabilities building up on their books.

When an employer doesn’t pay their employee’s super, they are liable for the super

guarantee charge and this is much more than the super they would have otherwise

paid to the employee’s fund. It’s also not tax deductible.

Regardless, unpaid super increased from just below a billion dollars before the

pandemic, to over $2 billion today.

Our focus on payment of super guarantee charge debts is not new and we have

5 of 12

long held the importance of enforcing payment of these debts. We review every

complaint of unpaid superannuation guarantee. We also monitor payments to

ensure employees receive correct and timely superannuation entitlements.

The non-payment of superannuation impacts employee’s future retirement savings,

they are the very people helping support businesses to grow.

While we have always taken a strong stance on collecting these debts, we will be

doubling our efforts and increasing firmer actions. This is called out in our latest

Corporate Plan as a key focus area.

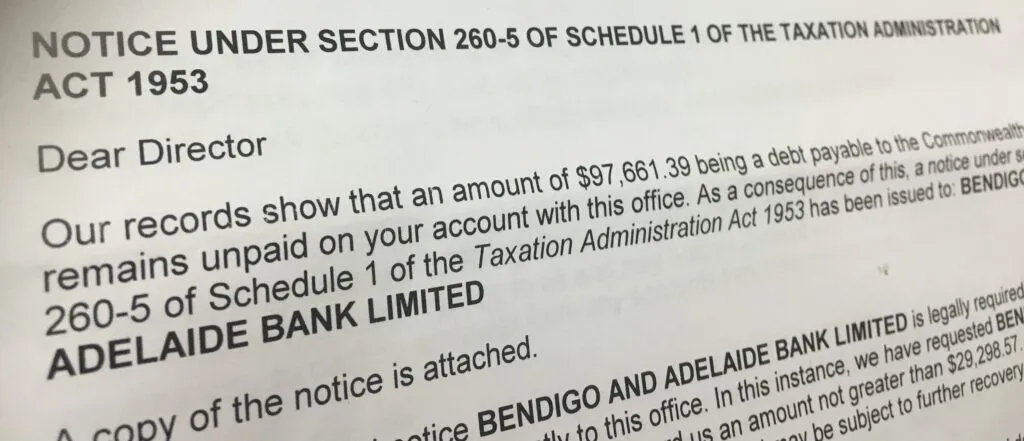

We will continue to apply a full range of firmer actions including garnishees,

directions to pay, director penalty notices, disclosure of business tax debt and

prosecution actions, to ensure payment.

Where businesses continue to trade without addressing their super guarantee

charge debts, we will escalate our actions towards wind up and bankruptcy where

appropriate.

We are serious about collecting unpaid super. We will be continuing to detect

employers who are taking advantage and not paying the relevant entitlements to

their employees.

These employers will be held to account.

Debt arising from ATO audit adjustments

We continue to focus on debts raised through our audit initiated funded programs

including GST Compliance Program, Tax Avoidance Taskforce, Shadow Economy,

and Serious Financial Crime.

While most unpaid debt is self-assessed, we deliver our audit programs for a

reason, and it’s important we enforce payment as an outcome of the audit – it’s not

just about raising revenue.

The community would expect nothing less.

Some audit adjustments do relate to genuine errors, but some are because the

taxpayer or their agent was careless or reckless or perhaps deliberately avoiding

paying the right of amount of tax. These clients will receive no concessions, with

heightened expectations of clients to pay regarding liabilities raised.

Refund fraud

No doubt you would be familiar with recent media reports outlining growing refund

fraud attempts.

Unsurprisingly, the ATO views fraud very seriously and taxpayers who engage in

refund fraud can expect serious consequences.

This is nothing more than blatant theft against the community.

6 of 12

We have a very clear and deliberate approach to recovering debts related to

fraudulent behaviours, and we won’t hesitate to apply this to all clients involved.

We will fully extend our stronger powers where necessary beyond our ordinary

posture for these clients, this includes prohibiting overseas travel through departure

prohibition orders while debts remain unpaid.

Consequences will be felt, they will be real, and we will be persistent – this won’t go

away.

Only last week we issued a media release noting a Mildura man has been

sentenced in the County Court of Victoria this week to 7.5 years in prison.

Aged, high-value debts

Another key driver of collectable debt is aged, high-value debts.

This year we are doubling our efforts to take recovery actions on these debts.

The 2023-24 Budget funded a 4-year program to focus on Public and multinational

groups and privately owned groups with debts over $100,000 or debts that have

been overdue for more than 2 years.

For these clients, concessions are no longer available, and their debts will progress

straight to firmer actions.

Payment plans will be limited, and those that are accepted will need to be

completed within shorter periods and align with reporting cycles.

Clients unable to get back on track and demonstrating signs of insolvency through

no capacity to pay, can expect legal recovery actions.

Over the life of this program, we expect to action just under 40,000 accounts with

overdue tax and super debts and collect around $640 million. We also expect that

there will be exits.

Employers with new self-assessed debts

For employers with new debts, we see opportunities to secure the future of on-time

payment by taking immediate action.

With the introduction of Payday Super in 2026, and a future where tax and super

just happen, businesses need to get used to paying tax in real time.

The time is now to maintain positive payment behaviours. That’s why for

businesses with new self-assessed debts, we will take swift action and uphold the

consequences and impacts of delaying payment.

This includes applying interest, penalties, and progressing to firmer actions.

It will ensure that clients will pay more if they don’t pay on time. Those who pay on

time, won’t.

7 of 12

Payment plans and general interest charge remissions will be reserved for those

who genuinely need the support; and will become the exception rather than the rule.

Clients who need more time and support, should contact the ATO before they

decide not to pay on time. This will be critical in influencing future payment

behaviours, moving away from a culture of ‘waiting until the ATO contacts you

before paying’ and prevent accumulating debt.

Shifting payment behaviour

We are determined to shift payment behaviours for the good of the Australian

community.

Taxpayers who need support to pay, need to contact us or speak to their tax

professional before they choose not to pay – that means before the due date.

Over the past 12 months, we have increased our propensity to use firmer and

stronger actions.

Some of the key actions we use are:

Director penalty notices and disclosure of business tax debt

There remains over $5 billion dollars owed by clients who currently meet the criteria

for disclosure and all signs point to this amount continuing to increase.

It’s not fair for businesses with large outstanding debts to continue to use the ATO

as a low interest loan facility and it’s clear that disclosing business tax debts

provides strong incentives for engagement with the ATO regarding these debts.

Our use of director penalty notices and the opportunity to disclose business tax

debts have already shifted the business landscape in relation to ATO debt recovery.

Since July 2022, over 24,000 director penalty notices have issued to individual

company directors in respect to over 18,000 companies.

Last financial year, we issued close to 19,000 Intent to Disclose Notices to clients

who fit the criteria for disclosure of business tax debt.

One in 3 taxpayers subsequently took action to engage with us.

Over 2,000 clients paid their debts in full. That’s over half a billion dollars of ATO

debt paid once the business knew we were going to disclose their debts.

Of the 867 business tax debts that were disclosed to credit reporting bureaus,

185 businesses re-engaged with the ATO following the disclosure.

Insolvency

We know that not all businesses are viable and having a tax or super debt is often a

8 of 12

symptom of insolvency.

You have probably seen in the media recently that insolvencies have been on the

rise after a slowdown in the last few years.

The ATO is party to many insolvencies, and we are often a major creditor.

Generally, corporate insolvency action is initiated by commercial entities with only 1

in 6 insolvencies initiated by the ATO.

We do not make the decision to commence wind-up proceedings lightly, and this is

only after the company has been afforded ample opportunity to re-engage and

address its debts.

But we will go down this path if we need to.

When you look at the numbers, we commenced almost double the number of

winding up cases in the Federal Court between 1 January – 31 July 2019,

compared with the same period in 2023.

That’s a change from approximately 950 winding up cases for those 6 months in

2019, down to approximately 478 for those 6 months in 2023.

The ATO can and will take actions, such as court-imposed liquidation if a debt

remains unpaid.

We intend to continue increasing legal recovery actions this year to return to more

normal pre-pandemic levels, with approximately 100 wind-ups filed in July 2023

alone.

Small Business Restructuring (SBR)

The ATO does not provide advice to tax debtors on insolvency processes, however,

one option available to small businesses may be small business restructuring

(SBR).

The SBR process is designed to allow financially distressed, but commercially

viable businesses, the opportunity to restructure their debts whilst continuing to

trade.

If you know your clients are struggling to pay their debts, talk to them about the

streamlined restructuring or insolvency measures the government has established

to support better outcomes for small businesses, creditors, employees and the

economy.

There are 3 phases to the SBR process:

1. The proposal phase where the directors and restructuring practitioner work on

a plan for up to 20 business days.

2. The acceptance phase where creditors have up to 15 business days to vote

thereby approving or rejecting the plan.

9 of 12

3. The plan implementation phase which is limited to a 3-year term but may be

completed sooner depending on the terms of the plan.

Typically, a restructuring plan will either involve a cash lump sum payment into the

plan on or shortly after approval by creditors, or by way of monthly instalments over

a period of up to 36 months.

On completion of the terms of plan, the company is released from all debts subject

to the plan.

Restructuring appointments have been averaging 47 per month throughout 2023

and we expect the number of monthly appointments to continue to increase during

the 2024 financial year.

92% of restructuring plans received since 2021 have been accepted by creditors.

To date, the ATO has supported most restructuring plans, voting in favour of 91% of

them.

Each plan is assessed on its merits and our voting history shows our commitment to

supporting businesses through restructuring.

In determining whether to accept a plan, we consider:

the commercial terms in comparison to a hypothetical return in a liquidation.

the ability of the company to make the payments under the plan on time and in

full. If the company defaults on a payment, they have 30 business days to

remedy the breach otherwise the plan will terminate.

the company’s compliance history and that of related parties or entities.

the behaviour of the directors in relation to any loan accounts with the

company.

potential breaches of the Corporations Act.

Where the Commissioner is the major creditor in a restructuring appointment, the

ATO is open to providing feedback on the draft restructuring plan prior to it being

finalised and formally issued to creditors.

How you can help us

The key emphasis in this speech is reaching out to the ATO early to help us

understand your situation. We will continue to have dedicated resources to

supporting vulnerable clients. We have a number of options available including

payment plans, remission of penalties, deferrals of payment or lodgment, release of

debt and hardship provisions. The Commissioner also talked yesterday about the

importance of ongoing collaboration and partnerships with the profession, which

includes our approach to managing debt.

Shifting the payment culture will need a collaborative approach.

Our aim in resetting our approach is to position businesses to avoid falling behind in

the first place, and position them better to be able to recover if they do fall behind.

10 of 12

Some will need more help than others, and as trusted advisors for your clients, and

partners with the ATO, you can help clients avoid bill shock by setting up habits that

see them put aside the money that they have collected or withheld from others, so

they can pay it when it is due.

You can reinforce that they are only the temporary custodians of GST, pay as you

go withholding and super guarantee, it’s not theirs.

You know the signs when a business is struggling, on the brink of insolvency or

perhaps needs to be told the time has come to exit gracefully.

Having these conversations at the right time, rather than waiting for us to take

action will ensure clients are best place to manage their bills and avoid taking

actions that may have more lasting effects.

Please encourage your clients to talk to you if they are genuinely experiencing

financial difficulties, or to contact us as soon as possible if they need our support.

Support for you

We appreciate that you are busy and that helping your clients with their debts takes

time.

We expect that taking decisive actions sooner will encourage those who can, to pay

in full and on time. We are further working to prioritise these actions for clients with

higher value debts, engaging in fraudulent activity, impacting the future of their

employees and in response to the clear commitments we have to government.

In November this year, we will be increasing the self-serve payment plan threshold

to $200,000 for those who don’t have the capacity to pay in full. We hope that this

will save you time if you are assisting your clients who genuinely need the support

as it will reduce your need to contact us directly.

We are also helping you by making our interactions more efficient.

Tax professionals have told us that our calls can be untimely, and don’t allow them

to prepare for the conversation, resulting in a game of telephone tag.

We hear this feedback, and we are making appropriate adjustments.

We have recently implemented a change to streamline our lodgment and payment

interactions with you.

If our initial contact with you is unsuccessful, we will use Online services for agents

practice mail messages to provide you with information about your client’s overdue

lodgment and payment obligations, along with the necessary actions to be taken.

The information when attached in practice mail can be forwarded to your clients or

used as the basis for conversations with them.

Conclusion

11 of 12

Today I’ve been speaking about the collection part of revenue collection. The ATO

has a critical role in protecting not just the revenue but also the taxpayer themselves

– from creating too much debt, the creditors, level playing field and the broader

economy.

It’s essential we shift the payment culture in parts of the community for the good of

the Australian community. Australia needs all taxpayers to pay the right amount of

tax, in full by the due date, and employees need their employers to withhold and pay

their correct entitlements, including their pay as you go withholding and super.

If I can leave you with one final message, it’s to acknowledge your role as not just a

trusted adviser, but also a cultural touchpoint for the way Australians see the need

to pay tax on time. My request is that you help your clients understand that it’s in

their best interests to pay on time and engage with us, rather than waiting for us to

engage with them. Thank you for your attention and I’m looking forward to your

questions.

Are you eligible for Small Business Restructuring?

If your business is under financial stress and suffering from tax debt, a Small Business Restructure may be a good solution.

Leave a Reply