#1 Australia’s Top Independent SBR Practitioner*

SMALL BUSINESS RESTRUCTURING

Reduce business debt & keep trading

Struggling with cashflow, creditors and tax debt? Small Business Restructuring (SBR) might be the lifeline your business needs.

Merv – Business Advisory

The SBRS team have been nothing short of amazing from day one! Given the last few years of global economic challenges we found ourselves in a very difficult financial position that we thought we wouldn’t be able to recover from, the team supported us through our options and guided us on how we could provide a solution to the government to enable our business to continue. Without their hard work and diligence we don’t think we could’ve survived – they were literally a lifeline to our business. Couldn’t recommend them more!

Festival organiser restructure

It’s no secret that the live music industry and the hospitality sector was highly impacted during the Covid-19 pandemic. The debt compounded and all our pleas to government fell on deaf ears. Along came the SBRS team to the rescue! They instantly gave my business solutions and spoke to the government on my behalf to help us manage debt and not become insolvent. I cannot recommend these guys highly enough for their strength and support during such challenging times.

Mark P. QLD Builder

Our QBCC credentials were up for renewal, and as part of that we needed to show solvency which we couldn’t do due to the amount of tax debt we were carrying and the ATO payment plan. Brad and the team looked at our situation and were confident they could negotiate a debt reduction and payment plan that would meet the QBCC criteria. We now have less debt, QBCC certificate and I personally have time to spend on bringing in new business.

Jane A. Coffee shop

I was out of options after all the COVID support stopped, and we were weeks if not days from shutting the doors for good, when a customer mentioned restructuring and gave me Thomas’s number. It was literally a gamechanger and lifeline for us, and the team at SBRS were so supportive, understanding and you could tell they just wanted to help.

James B. Roof plumber

Thomas, Brad and the whole team at SBRS were amazing throughout the whole process. From the first phone call I just felt the weight on my shoulders just seemed to get lighter by the day, and 3 weeks in they were doing their thing and left me to get on with running the business. Hands down the best business decision I’ve made in a long time was making that first phone call to them.

Why consider Small Business Restructuring (SBR)?

Take back control of your business and your future

The Small Business Restructuring Program (SBRP) allows business owners to restructure and reduce debt, remain in control and continue trading, without the need for external administration or liquidation. You get back to running your business.

Sleep better knowing there’s a plan

Get peace of mind with a simple, government-backed Small Business Restructure (SBR) plan. Once our practitioners are appointed we stop all ATO and creditor actions whilst we prepare our restructure proposal, allowing you to concentrate on running the day to day.

The best outcome for all parties

Small Business Restructuring (SBR) is the fastest growing insolvency solution which offers the best outcome for everyone – creditors, ATO, suppliers, employees, customers, and you the owner. No one wins when a business shuts down.

The first day of the rest of your business life

Small Business Restructuring (SBR) gives businesses a fresh start, with reduced manageable debt arrangements, a better ATO relationship, a renewed focus on building rather than saving the business, and quite literally a second chance of success.

THE BASICS

What is Small Business Restructuring (SBR)?

A Small Business Restructure (SBR) is a government-legislated solution designed to help eligible Australian businesses reduce debt and regain control — all within 35 business days.

Through this process, business owners appoint a licensed Small Business Restructuring (SBR) Practitioner to develop a plan that’s approved by the ATO and other creditors. The plan focuses on reducing debt and implementing workable solutions to restore cash flow, keep the business trading, and get things back on track.

Take back control of your business and your future

The Small Business Restructuring Program (SBRP) allows business owners to restructure and reduce debt, remain in control and continue trading, without the need for external administration or liquidation. You get back to running your business.

Key benefits of a Small Business Restructure (SBR)

- 100% Legal Government Program

- Directors keep control of the business

- Puts a stop to creditor actions

- Significant debt reduction

- Remain trading, retain staff

- Provides financial clarity and manageable

payment plans

CASE STUDIES

See how a Small Business Restructure helped these Aussie businesses

See how we helped this business restructure their debt and reduce monthly payments while keeping operations running

No case studies found.

CHECK YOUR ELIGIBILITY

Ready to get your business back on track?

Check if your company is eligible for restructuring in 60 seconds.

TESTIMONIALS

What our clients say

Merv

Owner Business ConsultingMerv – Business Advisory

The SBRS team have been nothing short of amazing from day one! Given the last few years of global economic challenges we found ourselves in a very difficult financial position that we thought we wouldn’t be able to recover from, the team supported us through our options and guided us on how we could provide a solution to the government to enable our business to continue. Without their hard work and diligence we don’t think we could’ve survived – they were literally a lifeline to our business. Couldn’t recommend them more!

Owner Festival Organiser

Festival organiser restructure

It’s no secret that the live music industry and the hospitality sector was highly impacted during the Covid-19 pandemic. The debt compounded and all our pleas to government fell on deaf ears. Along came the SBRS team to the rescue! They instantly gave my business solutions and spoke to the government on my behalf to help us manage debt and not become insolvent. I cannot recommend these guys highly enough for their strength and support during such challenging times.

Mark P.

Owner QLD BuilderMark P. QLD Builder

Our QBCC credentials were up for renewal, and as part of that we needed to show solvency which we couldn’t do due to the amount of tax debt we were carrying and the ATO payment plan. Brad and the team looked at our situation and were confident they could negotiate a debt reduction and payment plan that would meet the QBCC criteria. We now have less debt, QBCC certificate and I personally have time to spend on bringing in new business.

Jane A.

Owner Coffee shopJane A. Coffee shop

I was out of options after all the COVID support stopped, and we were weeks if not days from shutting the doors for good, when a customer mentioned restructuring and gave me Thomas’s number. It was literally a gamechanger and lifeline for us, and the team at SBRS were so supportive, understanding and you could tell they just wanted to help.

James B.

Owner Roof plumberJames B. Roof plumber

Thomas, Brad and the whole team at SBRS were amazing throughout the whole process. From the first phone call I just felt the weight on my shoulders just seemed to get lighter by the day, and 3 weeks in they were doing their thing and left me to get on with running the business. Hands down the best business decision I’ve made in a long time was making that first phone call to them.

FAQ

Commonly asked questions

Under legislation, only a person registered with ASIC as a ‘registered liquidator’ can act as a Restructuring Practitioner or administer a restructure plan.

Typically up to 35 business days – as mandated by the Corporations Act. Once started, we have up to 20 business days to finalise a plan. This is followed by a 15-business-day voting period.

That is just 7 weeks!

All affected creditors are able to vote on whether to accept a plan. However, once a plan is approved all eligible creditors must abide by its terms. 50% or more approval by creditors (based on dollar amount) is required for a restructure to be accepted and all creditors are bound by the decision.

Commencement of the restructuring process means affected creditors cannot continue or commence court or other recovery action against the company without the consent of the restructuring practitioner or approval of the court.

All initial consultations are free and will ascertain whether your business meets the eligibility criteria.

The cost of the process is fixed and dependent upon the complexity of the restructure.

LEARNING CENTER

Essential resources for smarter business decisions

7 Risks of using personal loans to clear business debts

Taking on personal credit to clear company debts can seem like a quick fix, but…

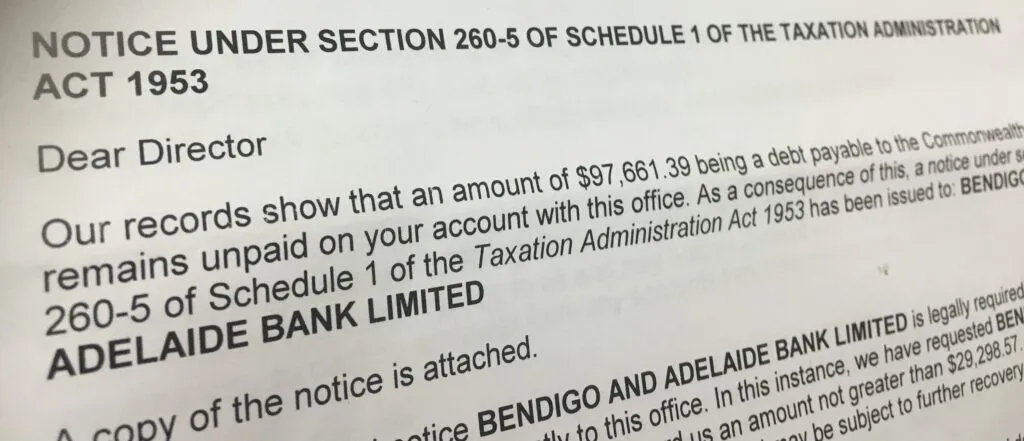

Received a Garnishee Notice? What You Should Do Next

What is a Garnishee Notice? When a business receives a garnishee notice from the Australian…

I’ve received a DPN, what does this mean for my business?

Introduction to a DPN (Director Penalty Notice) A Director Penalty Notice (DPN) from the Australian…