What does it mean if I’ve received a winding up order?

If your company has outstanding debts owed to another business or individual, that entity is referred to as a creditor. Under certain circumstances, a creditor has the option to initiate a process to wind up your company due to insolvency. Insolvency occurs when your company is unable to meet its financial obligations. Typically, a creditor pursues a winding up application if you have not complied with a statutory demand, signaling your company’s presumed insolvency. In this scenario, it’s crucial to act swiftly upon receiving a winding up notice. This article outlines the steps a creditor may follow to obtain a winding up notice and offers guidance on how to respond.

Understanding a Statutory Demand:

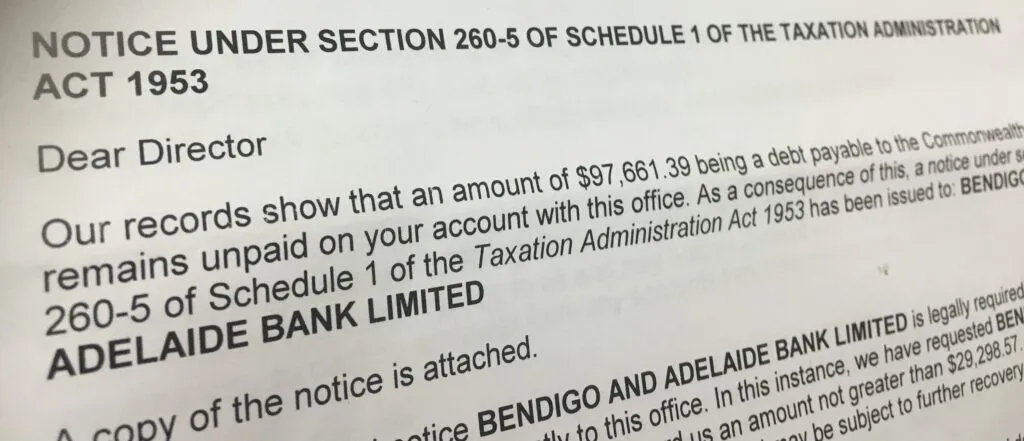

A statutory demand is typically the initial action taken by a creditor before proceeding with a winding up order. It is a formal, written request demanding that a company settle an outstanding debt within 21 days. This serves as a significant first step in the debt recovery process.

Upon receiving a statutory demand, you have 21 days to respond by either:

Complying with the demand, which generally involves settling the debt in full or negotiating a suitable arrangement with the creditor.

Applying to the court to set aside the statutory demand. This is a complex process requiring you to demonstrate defects in the demand or a reasonable defense for not paying the debt.

Failing to respond appropriately within the 21-day period results in the presumption of your company’s insolvency. This presumption remains valid for three months from the end of the initial 21 days, during which the creditor can commence court proceedings to initiate the winding up of your company.

It’s essential to note that a winding up notice may not be the creditor’s first course of action when pursuing a debt. The statutory demand allows the creditor an opportunity to resolve the matter before seeking a winding-up order.

The Process of Obtaining a Winding Up Order:

Once the 21-day period elapses, the creditor may take steps to wind up your company. The process involves:

Filing an originating process with the court to initiate proceedings, including attaching a copy of the statutory demand.

Submitting evidence supporting the debt, including details regarding the demand’s service, your non-compliance, and the remaining debt amount.

Serving you with the originating process within 14 days of filing the application.

Notifying the Australian Securities and Investments Commission (ASIC) of the application for winding up orders.

Appointing an official liquidator to act as your company’s liquidator if the winding up order is granted.

Publishing a notice of the application on the ASIC website’s insolvency notices page to inform other businesses of your company’s insolvency.

Response Options Upon Receiving a Winding Up Notice:

If you receive a winding-up notice, you have three primary response options:

Non-Action: If you take no action, the winding up notice will specify a court date. Failing to respond before this date will result in the court ordering the winding up of your company. At this point, a liquidator will be appointed, and your company’s assets will be sold. Directors may become personally liable for the company’s debts.

Payment of the Debt: If your company can afford to pay the debt, it is advisable to do so promptly. Full payment may lead the creditor to withdraw from the proceedings, halting the winding up process. Alternatively, you can propose a payment arrangement, although the creditor is not obligated to accept it at this stage.

Entering Into Administration: Administration can be initiated by either the creditors or the company’s directors. It typically occurs when a company is insolvent or on the brink of insolvency. Under administration, an administrator is appointed to oversee the company’s affairs. Depending on the viability of the company, it may eventually resume trading, or the administrator may recommend further actions.

Entering into Small Business Restructure : the company can appoint and SBR after a winding up notice has been received, however the practitioner and the company must approach the court with justification of why SBR should proceed.

Continuing to Trade After Receiving a Winding Up Notice:

Receiving a winding up notice does not necessarily require you to cease trading immediately. In some cases, continuing to trade may assist in repaying debts. However, directors must be aware of their legal obligations to prevent insolvent trading. If your company is insolvent and you continue trading, you may become personally responsible for any new debts incurred.

Understanding the processes, obligations and options involved when receiving a winding up notice is crucial for both company directors and creditors. Timely and informed actions can significantly impact the outcome of this complex financial situation.

Are you eligible for Small Business Restructuring?

If your business is under financial stress and suffering from tax debt, a Small Business Restructure may be a good solution.