What is a Garnishee Notice?

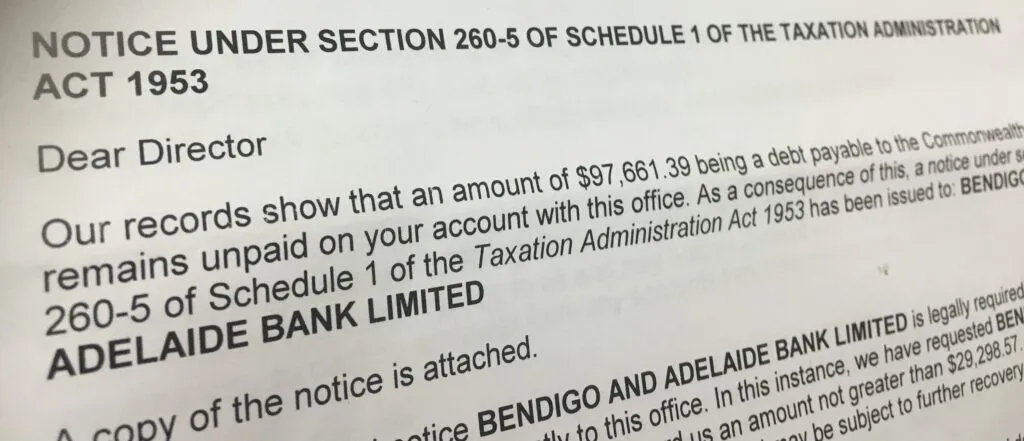

When a business receives a garnishee notice from the Australian Taxation Office (ATO), it means the ATO is taking direct steps to recover outstanding tax debts. This notice is sent to a third party that holds or will hold money on behalf of the business, such as a bank, employer, or contractor, instructing them to transfer funds directly to the ATO to reduce the debt.

Types of Garnishee Notices:

- One-Off (Point in Time) Notice: This notice requires a single payment from the third party, usually the lesser of the full tax debt or a specified percentage of the funds held. (Waterhouse Tax Lawyers)

- Ongoing (Continuing) Notice: This notice mandates that future funds owed to the business by the third party are continuously paid to the ATO until the debt is fully satisfied. (Waterhouse Tax Lawyers)

Immediate Implications of receiving a garnishee notice

- Financial Impact: Third parties are legally required to comply with the garnishee notice, which can lead to immediate deductions from the business’s bank accounts or payments from clients. This action can significantly impact cash flow and operational capabilities. (Stonegate Legal)

- Reputational Concerns: Involving third parties in tax matters can result in reputational harm, as it may expose financial difficulties to business partners and stakeholders. (Mondaq)

What to Do If Your Business Receives an ATO Garnishee Notice

Recommended Actions:

- Immediate Response: The business should contact the ATO as soon as possible to discuss options such as negotiating a payment plan or seeking a release from the garnishee notice. (Stonegate Legal)

- Seek Professional Advice: Consulting a tax professional or legal advisor helps the business understand its rights and obligations, as well as develop an effective strategy to manage the garnishee notice.

- Review Financial Arrangements: It’s also wise for businesses to reassess their financial standing to meet ongoing obligations and prevent further enforcement actions.

Proactively engaging with the ATO and seeking professional guidance are critical for businesses to navigate a garnishee notice and work towards resolving tax debts efficiently.

Garnishee Notice Summary

When the Australian Taxation Office (ATO) issues a garnishee notice, it means they’re taking direct action to recover unpaid tax debts. This legally compels a third party—such as your bank, clients, or contractors—to redirect funds to the ATO, which can immediately affect your cash flow and reputation.

Key Points Covered in This Article:

- The difference between one-off and ongoing garnishee notices

- How these notices can impact your financial stability and business relationships

- Why it’s essential to act quickly, contact the ATO, and seek professional help

- Steps to review your financial position and avoid further enforcement

If your business is facing a garnishee notice, proactive engagement and expert guidance are crucial for regaining control and resolving tax debt before the situation worsens.