In the realm of corporate finance and insolvency, the term “company liquidation” carries significant weight and implications. It is a process that may be undertaken for various reasons, whether a business is flourishing or facing financial turmoil. This guide delves into the intricacies of company liquidation, breaking down its essence, its execution, and the motivations behind such a pivotal decision.

Defining Liquidation:

Liquidation, in essence, signifies the comprehensive closure of a company’s financial operations. This procedure encompasses the sale of the company’s assets, with the intent of repaying its debts, either partially or entirely. During this process, the company’s organizational structure is systematically dismantled, and if financial issues triggered the liquidation, a thorough investigation into the root causes is conducted. Importantly, it’s worth noting that liquidation pertains solely to corporate entities operating within the structure of a company. It should not be confused with bankruptcy, which is a concept applicable to individuals, including sole traders and partners in partnerships.

The appointment of a liquidator is an integral aspect of the liquidation process. The liquidator assumes full control over the company’s operations, financial matters, and assets. Their primary objective is to ensure the efficient winding up of the company’s affairs

Triggers for Company Liquidation:

A company might embark on the path of liquidation under specific circumstances:

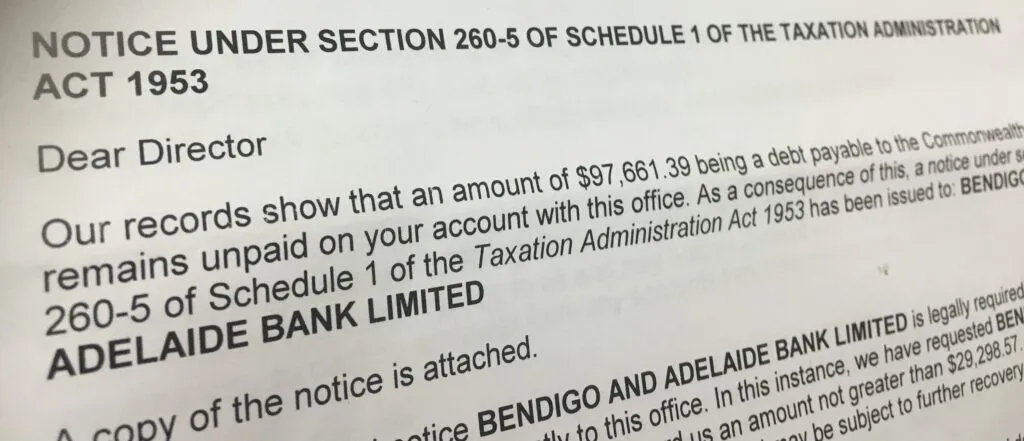

Inability to Meet Debts: When a company becomes incapable of fulfilling its financial obligations promptly, it may be compelled into liquidation by creditors. This process, known as court liquidation, involves legal proceedings and a court-issued order, often initiated through a winding-up application by creditors.

Voluntary Liquidation: Alternatively, a company may choose voluntary liquidation by the resolution of its directors and a majority of shareholders. This route is taken when the company acknowledges its financial distress and decides to proceed with liquidation willingly.

Types of Liquidation:

Several types of liquidation exist, each tailored to specific circumstances:

Creditors Voluntary Liquidation: This is the most common form of insolvent company liquidation. It commences voluntarily through a resolution passed by the company’s shareholders. It allows the company to act promptly, minimize potential consequences, and halt the accrual of further debt.

Members Voluntary Liquidation: In the case of a solvent company opting to cease operations, it enters into Members Voluntary Liquidation. This route is chosen when the directors believe the company can repay all current debts within twelve months of liquidation.

Simplified Liquidation: Aimed at businesses with creditors totaling less than $1 million, this form of Creditors Voluntary Liquidation streamlines the process, making it more cost-effective and accessible for small businesses.

Court Liquidation: Court Liquidation involves the appointment of a liquidator by the court, often initiated by a creditor’s statutory demand. It proceeds similarly to Creditors Voluntary Liquidation.

Provisional Liquidation: In cases where a company’s assets need protection from harm or loss, provisional liquidation is considered. It involves a court-appointed liquidator temporarily overseeing the company, which may or may not culminate in full liquidation.

Parties Involved in Liquidation:

During the liquidation process, various parties play distinct roles:

Directors: Directors must cooperate with the liquidator, providing all necessary company information and assisting in the orderly liquidation process.

Employees: Employees may be affected by liquidation, as their employment status and entitlements are subject to the liquidator’s decisions. However, some entitlements may be recoverable through the Fair Entitlements Guarantee (FEG).

Creditors: Creditors, including secured and unsecured creditors, have a vested interest in recovering debts owed to them. They participate in the liquidation process, attending meetings and potentially forming a committee of inspection to assist the liquidator.

Liquidator: The independent liquidator takes on the critical role of managing the company during liquidation, ensuring the protection of creditors, officers, and members. They are responsible for informing stakeholders and handling the distribution of assets.

Order of Payment During Liquidation:

The distribution of a company’s assets during liquidation follows a specific order:

Liquidation Costs: Initial costs associated with liquidation are covered.

Secured Creditors: Secured creditors, who hold collateral over the company’s assets, receive their dues first.

Priority Creditors: Priority creditors, such as employees, with legal precedence in liquidation, come next.

Unsecured Creditors: Unsecured creditors, lacking collateral against the company’s assets, are the final beneficiaries, receiving dividends if assets remain.

Reasons for Liquidating a Successful Business:

Surprisingly, even thriving businesses may opt for liquidation under certain circumstances:

Resolution of Disputes: Internal conflicts or disputes among directors and shareholders may lead to liquidation as a means to resolve irreconcilable issues.

Key Person Dependency: If a business heavily relies on the services of a single individual, a planned succession or exit strategy may necessitate liquidation.

Pre-CGT Asset Realization: For businesses built around pre-CGT (Capital Gains Tax) assets, liquidation offers a method to realize the proceeds of such assets.

Liquidation is not solely a measure for ailing companies but can also serve as a strategic choice for businesses to manage their financial affairs, especially in situations requiring a seamless transition.

After Liquidation: Options Available to Creditors:

Throughout the liquidation process, creditors maintain the right to request information from the liquidator. Creditors can arrange creditor meetings to stay informed about the progress of liquidation and, if necessary, select a new liquidator. The liquidator is obliged to provide requested information, unless unreasonable, irrelevant, or conflicting with their duties. Creditors may exercise their rights to stay informed and have a say in the proceedings.

In conclusion, company liquidation is a multifaceted process with diverse motivations and outcomes. Whether prompted by financial distress or strategic considerations, it is a significant step that impacts various stakeholders, including directors, employees, and creditors. Understanding the intricacies of liquidation and its implications is crucial when contemplating this pivotal decision.

Are you eligible for Small Business Restructuring?

If your business is under financial stress and suffering from tax debt, a Small Business Restructure may be a good solution.