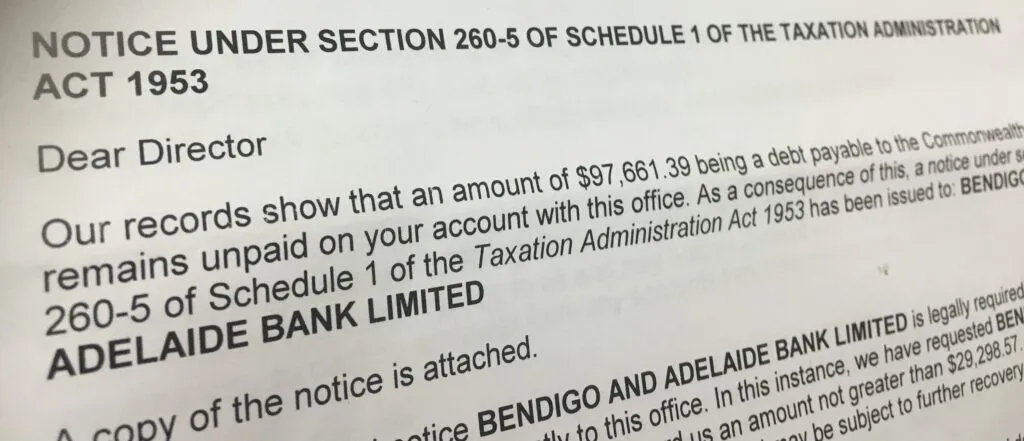

Introduction to a DPN (Director Penalty Notice)

A Director Penalty Notice (DPN) from the Australian Taxation Office (ATO) holds company directors personally liable for certain unpaid company tax debts, such as Pay As You Go Withholding (PAYGW), Goods and Services Tax (GST), and Superannuation Guarantee Charge (SGC). The ability to remit (remove) a director penalty through a payment plan depends on the type of DPN issued and the timing of the company’s tax lodgments.

Types of Director Penalty Notices

Non-Lockdown DPN

A Non-Lockdown DPN is issued when the company has lodged its tax statements within the required timeframes but has unpaid tax debts. Directors have 21 days from the date the notice is given to take one of the following actions to remit the penalty

Previously, entering into a payment arrangement with the ATO could remit the penalty under a Non-Lockdown DPN. However, as of April 2020, this is no longer the case; a payment plan does not remit the director penalty.

Lockdown DPN

A Lockdown DPN is issued when the company has failed to lodge its tax statements within the required timeframes, resulting in unreported and unpaid tax debts. In this scenario, the only way to remit the director penalty is to pay the debt in full. Neither entering into a payment plan nor other actions will remit the penalty under a Lockdown DPN.

Key DPN Considerations:

Payment Plans & a DPN

Payment Plans: While entering into a payment plan does not remit the director penalty, it may influence the ATO’s decision to pursue recovery actions against the director personally. The ATO may be less likely to take personal recovery action if the company is in a compliant payment arrangement and adheres to it. However, this does not remove the director’s personal liability.

Timely Lodgement & a DPN

Timely Lodgement: Ensuring that the company lodges its tax statements on time is crucial. Timely lodgement can prevent the issuance of a Lockdown DPN, which offers no remission options other than full payment.

DPN Conclusion

Entering into a payment plan does not remove a director penalty under a DPN. For Non-Lockdown DPNs, remission of the penalty requires specific actions within 21 days, and a payment plan is not among them. For Lockdown DPNs, the only way to remit the penalty is by paying the debt in full.

It’s essential for directors to act promptly upon receiving a DPN and seek professional advice to understand their obligations and options.

DPN Simple summary

A Director Penalty Notice (DPN) from the ATO can make company directors personally liable for unpaid PAYG, GST, and superannuation debts. This guide explains the two types of DPNs—Non-Lockdown and Lockdown—and what actions directors must take to avoid or address personal liability. It also clarifies why entering a payment plan may not be enough, and why timely lodgement of tax statements is crucial. Business owners should act quickly and seek professional advice as soon as a DPN is issued.

Useful Links & Resources on Director Penalty Notices (DPN)

- ATO Guide to the Director Penalty Regime

Understand how a DPN works and when directors become personally liable for company tax debts. - What Happens If You Don’t Pay a DPN – ATO Overview

Learn the ATO’s approach to unpaid tax debts and possible enforcement actions. - Directors’ Responsibilities Summary – ATO

A helpful summary of a director’s legal duties, including the risk of a DPN. - Super Guarantee Penalties and DPNs – ATO Module

Guidance for employers on avoiding penalties related to super obligations under the DPN regime. - ATO Penalties Explained – Including Director Penalties

A comprehensive look at ATO-imposed penalties, including how DPNs are enforced.