When a business starts to struggle financially, it’s not always obvious when things have crossed the line into insolvency. Acting early can be the difference between turning things around or facing serious legal and financial consequences. Below are 10 warning signs that your business may need professional insolvency advice.

Top 10 Signs

1. Constant cash flow issues

If you’re regularly struggling to pay bills, suppliers, or wages on time, your business may be experiencing serious cash flow issues—often the first red flag of insolvency.

2. Your creditors are going unpaid

Falling behind on payments to suppliers, the ATO, or lenders indicates your business may be unable to meet its financial obligations, a core sign of insolvency under Australian law.

3. Your debt is growing faster than revenue

When debt continues to accumulate with no clear path to repayment, it’s a warning that your business may be financially unsustainable.

4. Sales are dropping—and not recovering

A significant decline in revenue can quickly spiral into insolvency, especially when overheads and loan repayments remain constant.

5. Your business has a negative net worth

If your liabilities exceed your assets, your business may be technically insolvent. This is a strong signal to seek advice immediately.

6. You can’t secure additional funding

Lenders refusing to offer more credit? It likely means your business is being viewed as high risk, another sign that insolvency may be looming.

7. There’s no clear plan to recover

Operating without a realistic turnaround strategy or updated business plan means you’re not actively addressing the root causes of financial trouble.

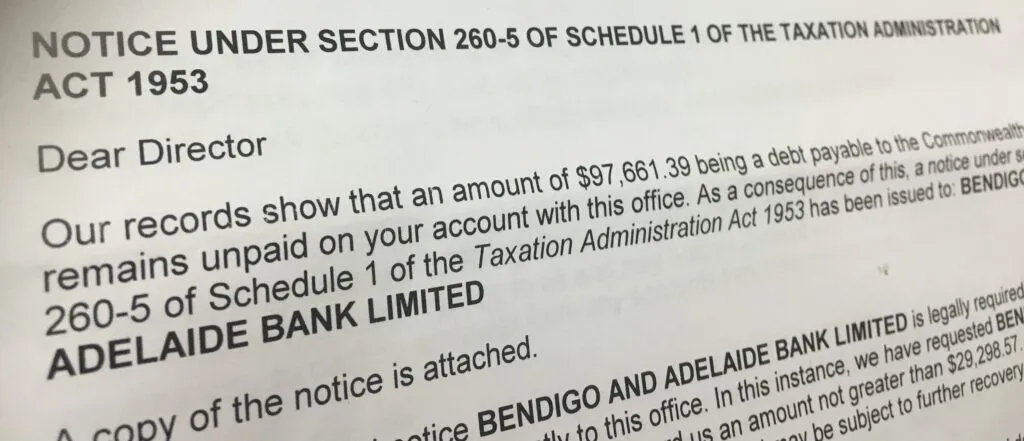

8. You’re behind on tax payments

Late or missed payments to the ATO for GST, PAYG, superannuation, or income tax are a clear indicator of cash flow problems and potential insolvency.

9. Staff morale is declining

Low employee morale, concerns over job security, or increased staff turnover can reflect internal knowledge of financial instability.

10. You’ve received a warning from the ATO

An ATO letter regarding unpaid obligations isn’t just a compliance issue—it’s often a sign that your business is already struggling to stay afloat.

What should you do if these signs sound familiar?

If your business shows multiple signs of financial distress, it’s time to speak with an insolvency expert, accountant, or restructuring advisor. Acting early gives you access to more options—including:

- Small Business restructuring

- Voluntary administration

- Safe Harbour protection

- Liquidation (if necessary)

Why early action matters

Ignoring the signs of insolvency can lead to director liability, loss of control, or worse—personal bankruptcy. The earlier you act, the more likely you are to protect both the business and your personal finances.

Need confidential advice? Reach out to a licensed insolvency practitioner today to explore your options and get your business back on track.